Let's face it, the world of investing can be intimidating. Market swings, confusing jargon, and the pressure to make the "right" moves can leave you feeling like you're in over your head. But what if investing could be smoother, more enjoyable, and way less daunting?

In this blog, we'll explore 10 practical steps to help you take control of your investments, build a portfolio you're proud of, and achieve your financial goals with more confidence and less stress.

I want you to think back to your childhood. Did you ever walk into school and see a huge jar of jelly beans on the teacher’s desk? What happened next? The teacher would ask everyone to guess how many jelly beans were in the jar. Some students analyzed the size of the jar and calculated how many jelly beans could fit, some knew roughly what one bag of jelly beans looked like and visualized how many bags could fit in the jar, and some simply guessed. Regardless of their approach, the average of all the guesses was consistently close to the true number. This is because the diverse perspectives and strategies of the students, when combined, resulted in a surprisingly accurate estimate.

This same principle applies to the stock market, where millions of investors with different information and strategies buy and sell shares every day. This collective action leads to what's known as market efficiency – the idea that stock prices quickly reflect all available information. These trades help set fair prices that contain loads of information about expected returns, which we can use to structure portfolios in a thoughtful manner. While the stock market is obviously far more complex than a jar of jelly beans, the underlying principle of collective wisdom holds true.

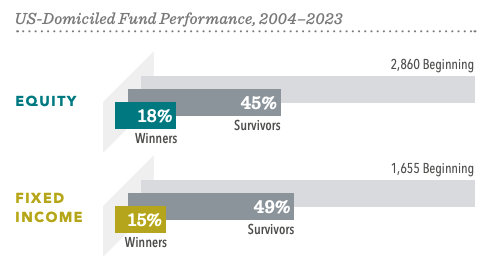

The jelly bean experiment shows us that a group's collective wisdom is often more accurate than any individual guess. This same principle applies to the stock market. With millions of investors constantly analyzing, buying, and selling, stock prices already reflect a vast amount of information. This means trying to "outguess" the market by predicting which stocks will go up or down is extremely difficult, and often unsuccessful. In fact, as the following graphic illustrates, the majority of active fund managers, even with their extensive resources and expertise, fail to consistently outperform the market over the long term.

By the time you think you've found a hidden gem or a looming disaster, that information is likely already baked into the price. Instead of trying to time the market or pick individual winners, a more reliable approach is to accept market efficiency and focus on building a diversified portfolio that aligns with your long-term goals and risk tolerance.

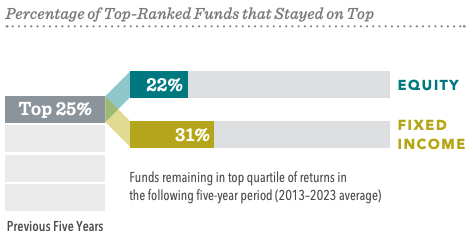

It's tempting to think a fund with a stellar track record is destined for continued success. We see a winning streak and can't help but imagine those profits continuing to roll in. But here's the catch: past performance is like looking in the rearview mirror. It tells us where a fund has been, not where it's going.

Think of it like this: Imagine a basketball team that won the championship last year. Does that guarantee they'll win again this year? Not necessarily! Players change, strategies evolve, and new competitors emerge. The same applies to investments.

In fact, studies show that most funds that perform exceptionally well over a five-year period don't stay at the top of the pack. Just like that championship team, their winning streak might be temporary. So, instead of chasing past performance, focus on a fund's underlying strategy, its risk profile, and how it aligns with your long-term goals. That's a much more reliable path to reaching your financial destination.

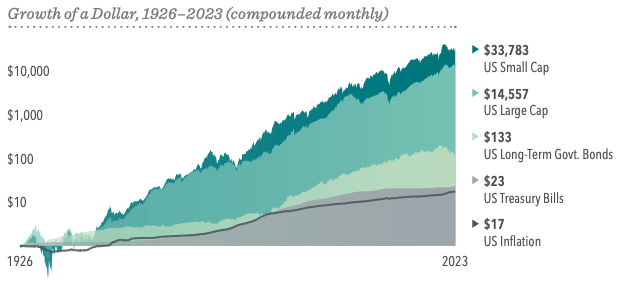

Imagine planting a seed and watching it grow into a tree. That's what investing in the market can be like. Over time, the stock market has consistently rewarded those who stay patient. It's like the soil nourishing the seed, helping it grow stronger and taller with time.

Of course, everyone wants to see their money grow, and history shows that the market has delivered. Stocks and bonds, like sunshine and water for our tree, have helped wealth flourish, even outpacing the erosive effects of inflation.

This long-term growth is why we encourage a steady hand and a focus on the future. Just as a tree needs time to reach its full potential, so too do your investments. By staying invested and weathering the occasional storm, you can reap the rewards of a market that, over time, has consistently helped investors grow their wealth.

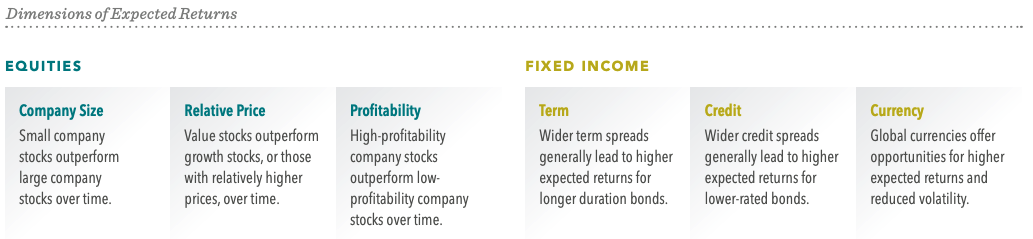

Ever find yourself wondering how exactly your investments grow? It's a question every investor should ask: where do those returns actually come from? Luckily, we're not flying blind! Academics and industry experts have spent decades studying this very question, and their research provides a clear roadmap to understanding investment returns. Think of it like this: they've uncovered the fundamental principles that drive investment growth. And the best part? You can use this knowledge to build a portfolio designed to capture those returns, no guesswork required. It's like having an expert architect design your financial future!

Imagine your investment portfolio as a baseball team. Would you want all your players to be pitchers? Probably not! A winning team needs a diverse roster with players who excel in different areas. Similarly, a well-diversified portfolio includes a variety of investments across different sectors of the market. This strategy helps to spread risk and protect your overall portfolio from the poor performance of any single investment. But don't limit your team to just local talent! Scouting players from across the globe can bring new strengths and perspectives to the game. Likewise, global diversification expands your investment universe, offering even greater potential for growth and resilience.

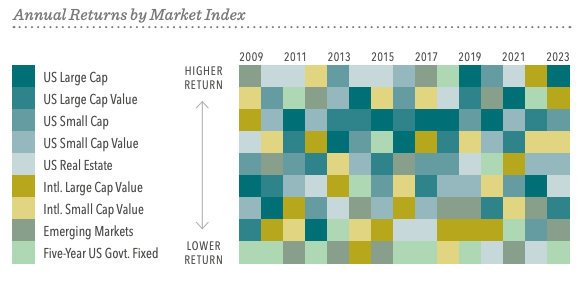

Predicting which areas of the market will outperform in any given year is like trying to predict the lottery numbers – it's nearly impossible. The market is constantly shifting, with different asset classes, countries, and sectors taking turns in the spotlight. Instead of trying to time these shifts perfectly, which often leads to missed opportunities and costly mistakes, embrace a diversified approach. By spreading your investments across the whole market, you're well-positioned to capture returns wherever they occur. This strategy is like having a safety net, ensuring that your portfolio isn't overly reliant on any single investment or market trend. It's a more reliable path to achieving your long-term financial goals, regardless of which way the market winds blow.

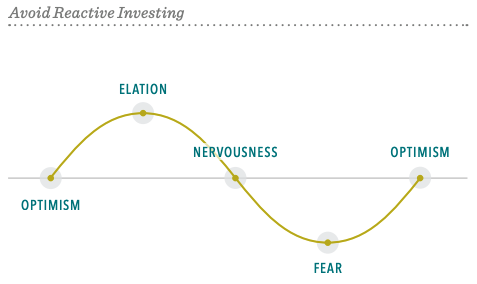

Investing can be a bit like riding a roller coaster. There are thrilling highs and stomach-churning lows, and it's easy to get caught up in the excitement or fear of the moment. But just like keeping your hands inside the ride at all times, it's crucial to keep your emotions in check when it comes to your investments. Remember, markets naturally go up and down, and reacting impulsively to those swings can lead to poor decisions, like selling low and buying high. Instead, take a deep breath, focus on your long-term goals, and stick to your well-crafted financial plan. It's like having a map that guides you through the twists and turns, ensuring you reach your desired destination, even if the ride gets a little bumpy along the way.

Imagine scrolling through your news feed and seeing a flurry of alarming headlines about the market. It's like being bombarded with sirens and flashing lights, tempting you to make a sudden, impulsive move. Some stories might fuel your anxieties about the future, while others lure you towards the latest investment craze, promising quick riches. But before you hit the panic button or jump on the bandwagon, take a moment to breathe. Remember that headlines are often designed to grab attention, not provide balanced perspectives. Instead of reacting impulsively, tune out the noise, go do something that brings joy to your life, and stick with your financial plan that was custom tailored to help you reach your goals.

In investing, it's easy to get distracted by things outside your control, like market fluctuations and economic headlines. But focusing on these external factors is like rearranging deck chairs on the Titanic – it might keep you busy, but it won't ultimately change the course. Instead, shift your attention to the things you can control. A financial advisor can help you develop a personalized plan, diversify your investments, manage expenses, and stay disciplined. By focusing on these actionable steps, you'll be well-equipped to navigate the complexities of the market and work towards your financial goals, regardless of what's happening in the broader economy.

You've now got the tools and knowledge to approach investing with a fresh perspective. Remember, a better investment experience isn't just about picking the "right" stocks or timing the market perfectly. It's about building a solid foundation, making informed decisions, and staying focused on your long-term goals. It's about understanding that investing is a journey, not a race, and that true success comes from navigating the complexities with confidence and clarity.

If you're ready to embark on this journey with a trusted partner by your side, we're here to help. Reach out to us today, and let's explore how we can help you achieve your financial aspirations and build a brighter future together.

Let’s make your goals happen, together.

Past performance is no guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustrative purposes only.

Source: Graphics provided by Dimensional Fund Advisors

Exhibit 1: In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. Funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days. Exhibit 2: The sample includes funds at the beginning of the 20-year period ending December 31, 2023. Each fund is evaluated relative to its primary prospectus benchmark. Survivors are funds that had returns for every month in the sample period. Each fund is evaluated relative to its primary prospectus benchmark. Winners are funds that survived and outperformed their benchmark over the period. Where the full series of primary prospectus benchmark returns is unavailable, non-Dimensional funds are instead evaluated relative to their Morningstar category index. Exhibit 3: This study evaluated fund performance over rolling periods from 2004 through 2023. Each year, funds are sorted within their category based on their previous five-year total return. Those ranked in the top quartile of returns are evaluated over the following five-year period. The chart shows the average percentage of top-ranked equity and fixed income funds that kept their top ranking in the subsequent period. Source (Exhibits 2 and 3): Data Sample: The sample includes US-domiciled, USD-denominated open-end and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar. Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/ Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, Global Large-Stock Blend, Global Large-Stock Growth, Global Large-Stock Value, and Global Small/Mid Stock. Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High-Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Long-Term Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, Global Bond, and Global Bond-USD Hedged. Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2024 FTSE Fixed Income LLC. All rights reserved. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US. Exhibit 4: In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. US Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. US Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor, Bureau of Labor Statistics. Data presented in the Growth of a Dollar chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Exhibit 5: Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Exhibit 6: Number of holdings and countries for the S&P 500 Index and MSCI ACWI IMI (All Country World IMI Index) as of December 31, 2023. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2024, all rights reserved. International investing involves special risks, such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Exhibit 7: In USD. US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US Government Fixed is the Bloomberg US Treasury Bond Index 1–5 Years. S&P and Dow Jones data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg index data provided by Bloomberg. Chart is for illustrative purposes only. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.